Ah. Birds chirping, warmer temperatures, and a distant lawnmower rolling across someone’s yard. Summer is nearly here, and I love it. But summer also brings many opportunities, such as vacations, trips to the beach or park, picnics, or even moving to a different home. The problem is, with interest rates up, can you still afford to buy a home? The answer might surprise you.

The key to affording a mortgage lies with careful financial planning, starting with defining your budget, income, monthly expenses, debt, and needs. You’ll also see better rates and loan terms if you take the time to reduce outstanding debt and save for a down payment.

Despite higher interest rates and home prices, the answer is simple. Yes. You can still buy a home in today’s market, but you must approach it with a plan and a budget. So, let’s dive in.

Set a Budget Before You Buy a Home

Most of us plan for things. When you shop, you make a list to do most of your shopping. You know what you plan to spend on a car, that new handbag, your wedding, and much more. But when it comes to budgeting, 27% of Americans don’t think they need one, according to a recent survey by Credit.Com.

Without a budget, many of us might overspend. But then, you wind up with one of those “uh-oh” moments. You know what I’m talking about…the heart-thumping, sweat-prickling, icy-in-your-veins feeling when you realize you’re fresh out of cash but still have automatic payments scheduled to come out.

Sticking to a budget helps you ditch those unpleasantries and gives you more freedom. Budgeting when you plan to buy a home is even more crucial.

A house is the biggest investment you’ll ever make. And it’ll undoubtedly take a lot of time to pay it off, which is why budgeting for it is so important.

So, review your budget and determine how much monthly mortgage you can afford, but leave some wiggle room. Life has a not-so-funny way of dishing out the unexpected when you’re least prepared.

Get a Mortgage Preapproval

There are a couple of pre-mortgage terms that are often used interchangeably: mortgage pre-qualification and mortgage preapproval. However, only one will give you a leg up against the competition when bidding on a home, while the other … not so much.

Mortgage preapproval is a secret weapon for home buyers facing stiff competition because it can give you a competitive advantage. Preapproval demonstrates to sellers that you’re serious about buying. It generally requires a hard pull of your credit report, and the lender reviews and determines if and what loan size you might qualify for.

Alternatively, mortgage qualification is generally based on self-reported financial information. If the lender pulls credit details, it’s usually a soft pull. Think of it like all those offers for credit cards you get in the mail that you never asked for or applied for. Someone reviews your basic credit details and believes you qualify.

Now suppose you decide to accept the pre-qualified credit card offer. First, you fill out the information. Then, when the credit card company does a hard pull on your credit report, you’ll discover whether you truly qualify.

Mortgage pre-qualification is similar in some ways. First, it’s a quick look at your financials. But whether you get approved for the loan only happens once underwriting looks deeper at your credit history.

If you plan on buying a home, getting a mortgage preapproval first is best.

Before You Buy a Home: Research Neighborhoods

Thoroughly research the neighborhoods before you buy a home. You never know when you might uncover hidden gems, amenities, or growth potentials. Of course, if you have children, you’ll also want to ensure the quality of the schools they might attend.

The National Institute of Realtors reports that 49% of buyers agreed that neighborhood quality was the most critical factor when determining the location of their next home.

So, how do you research a neighborhood? Here are a few tips.

- Visit the neighborhood on different days and times.

- Talk to your real estate agent.

- Speak with neighbors in the area.

- Check online resources.

- Research the neighborhood history.

Get a Professional Home Inspection

Unless you’re paying cash for your house – and some people do – you’ll need a home loan, and your lender will require a home appraisal before approving the loan. Getting a loan might be challenging if the house appraises lower than the price. Alternatively, hiring a professional home inspector can help alleviate those challenges and alert you to any costly problems, such as:

- Infestations

- Structural damage

- Water damage

- Electrical, plumbing, heating, or air conditioning issues

- Roof or chimney problems

Consider Immediate and Future Repairs

Does your future home need a few major repairs revealed by the home inspection? If so, you can negotiate contingencies before you sign the contract. Having contingencies allows you to back out of the home negotiation process if the seller fails to follow through on the repairs. Another option is negotiating a lower selling price if the house appraises less than expected.

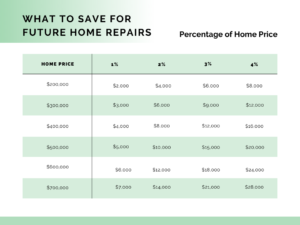

Alternatively, it’s also crucial to have money set aside for unexpected maintenance or repairs later. Plan on saving 1% to 4% of your home price to cover maintenance and repair costs. So, for example, if your home price were $400,000, you’d need to save between $4,000 and $16,000. I’ve crunched some numbers to give you an idea of a few other scenarios.

Some repairs, like a roof replacement, can be costly. You’ll be glad to have the extra funds should you need them later. Roof replacement costs vary but average around $11,500. Still, this cost can climb considerably higher depending on your roof type. So, saving 4% of your home price would give you enough to cover the current average roof replacement cost, should the need arise.

Ready to Buy a Home? Save a Down Payment

How much should you put down when you buy a home? The answer depends on your home price and the type of mortgage you choose.

For most conventional loans, the standard practice is 20% of your home price. That might mean saving a hefty nugget, depending on your home price. For example, if your home price is $400,000, you’d need $80,000 for a 20% down payment.

Some mortgages allow for a much smaller down payment of 10%, 6%, or even 3.5%. But remember, at least initially, smaller down payments translate to less equity in your home.

To compound matters further, any down payment of less than 20% also triggers a mortgage insurance requirement. Mortgage insurance protects your lender in case you default on your home loan.

There are two types of mortgage insurance:

- Mortgage premium insurance

- Private mortgage insurance

They work similarly, but the type of mortgage insurance you must pay depends on the mortgage. For example, FHA loans require a 3.5% down payment, but you might get stuck paying the mortgage premium insurance for the life of the home loan. Although, sometimes you can negotiate out of MPI once you’ve gained at least 20% equity in your home.

Private mortgage insurance is similar, but PMI comes with conventional loans. So, if you’re getting a 30-year fix-rate mortgage, for example, and you have less than 20% to put down, you’ll pay PMI each month on top of your mortgage payment. However, PMI will drop off your loan once the balance hits 78% of the original balance. In other words, once you’ve earned 22% equity in your home.

Want to eliminate PMI sooner? You might be able to negotiate dropping the PMI from your home loan once you’ve earned 20% equity in your home — your loan balance reaches 80%.

If you need financial help, there are down payment assistance programs, but it’s different for every state. So, check with your state housing authority. City and county governments and HUD-approved housing counselors are also excellent resources to point you in the right direction.

You’ll find different types of down payment assistance, from grants to loans — some forgivable.

Mortgage insurance aside, once you have a down payment saved, it’s time for your next step: getting preapproved for a mortgage.

Avoiding Buyer’s Remorse

You know that inky feeling you get that creeps through your veins after you’ve done something you really wish you hadn’t done? Buyer’s remorse happens to many of us. And it can even happen when you buy a home. But, there are ways to limit or avoid buyer’s remorse, depending on whether the regret relates to price, mortgage, or something else.

- Evaluate your budget – rerun those numbers.

- Reduce spending on non-essentials.

- Pick up a side hustle.

- Get a roommate.

- Decorate to make your home your own.

Of course, if you’ve tried all the above measures and you’re still experiencing regret or feelings of remorse affecting your daily life, don’t wait. Instead, seek a professional mental health counselor or therapist to help you through your emotions to find a reasonable solution.

Conclusion

The housing market will always fluctuate, as will mortgage rates. If you want to buy a house, and you’ve planned accordingly and followed the tips above, you can find your dream home. However, remember to keep things reasonable and that you don’t need to cross off every “want” when you buy a home. Sometimes part of the journey is transforming a home over the years, especially since your wants and needs change over time.

Stick to your budget; That’s the essential part. Going over budget on a home can result in an unaffordable mortgage payment and unnecessary financial stress later. However, with the right attitude and approach, you can confidently start the journey to owning a home.